The article in the url below suggests that the producers of lab-grown diamonds are overcoming one of the main criticisms levelled at their products – that they consume large amounts of energy to manufacturer, so are not nearly as green as they are marketed:

"A decade ago, they were relatively unknown in the jewelry industry, but now make up a fifth of diamond sales by value. … Made largely in China and India, lab-grown diamonds are produced using heat and pressure but without any mining. The lab-growing process, however, does require huge amounts of energy, so stones' green credentials depend on where the power comes from."

Having solved the issue of having to dig these things out of the ground (often under appalling conditions), the next step was to remove the emissions associated with the vast amounts of energy required to produce lab-grown diamonds:

"Danish jeweler Pandora's diamonds are made using renewable energy and set in recycled gold and silver rings. It said a cut and polished one carat diamond has a carbon footprint of roughly 9.2 kilograms, less than a tenth of the carbon emissions for a natural diamond—106.9kg CO2 based on research from the Natural Diamond Council."

Similarly:

"In 2019, Laura Lambert launched Fenton, an ethical jewelry brand based in London. Three years later the former retail executive started selling lab-grown diamonds produced in a solar-powered factory in Gujarat, India. … She says her own market research indicates currently only about 5% of all lab-grown diamonds are made using renewable energy, but it has been something her customers have been asking for."

As a result of the growing market share of lab-grown diamonds:

"Miners' revenues have dropped sharply. De Beers, the world's largest diamond miner, sells its rough diamonds in ten selling cycles during the year. The volume and quality can vary but is a good barometer of appetite for natural diamonds, as well as prices. In the last cycle of 2023, De Beers sold $130 million worth of diamonds compared with $417 million a year prior."

In spite of this progress, lobbyists for real diamonds are still able to question the sustainability of lab-grown diamonds (see Strategic CSR – Diamonds):

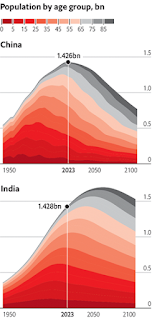

"'Consumers are being told that lab-grown diamonds are sustainable and that couldn't be further from the truth,' says David Kellie, CEO of the Natural Diamond Council, a diamond mining trade group. The group began airing videos on social media in April as part of what it calls a 'myth-busting' campaign. According to a new report by the group, more than 60% of lab-grown diamonds are made in China and India, where climate-polluting coal is the major power source. The report also touts efforts by the mining industry to cut carbon emissions and boost the economies of countries with major diamond mines such as Botswana and Namibia."

Take care

David

David Chandler

© Sage Publications, 2023

Instructor Teaching and Student Study Site: https://study.sagepub.com/chandler6e

Strategic CSR Simulation: http://www.strategiccsrsim.com/

The library of CSR Newsletters are archived at: https://strategiccsr-sage.blogspot.com/

Lab-Grown Diamonds Go Green

By Yusuf Khan

January 11, 2024

The Wall Street Journal

Late Edition – Final

B6